Renters Insurance in and around Little Rock

Looking for renters insurance in Little Rock?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Your belongings are important and so is keeping them safe. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your couch to your books. Overwhelmed by the many options? We have answers! Missy Herron wants to help you consider your liabilities and help select the right policy today.

Looking for renters insurance in Little Rock?

Coverage for what's yours, in your rented home

State Farm Has Options For Your Renters Insurance Needs

When renting makes the most sense for you, State Farm can help guard what you do own. State Farm agent Missy Herron can help you identify the right coverage for when the unpredictable, like a fire or a water leak, affects your personal belongings.

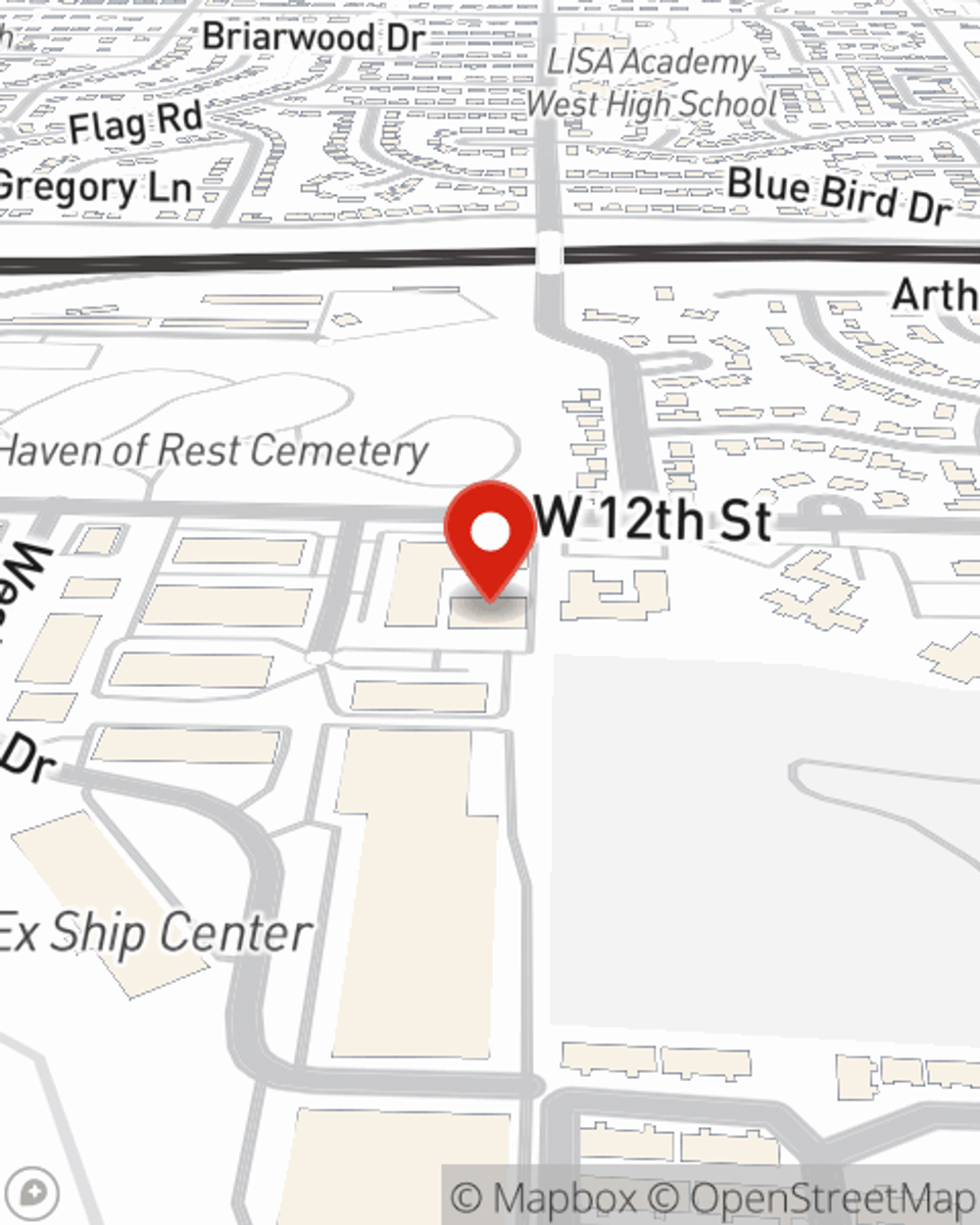

More renters choose State Farm® for their renters insurance over any other insurer. Little Rock renters, are you ready to discover the benefits of a State Farm renters policy? Call or email State Farm Agent Missy Herron today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Missy at (501) 664-3400 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Missy Herron

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.